If you know the structure of a Pyramid Scheme it is easier for you to avoid it.

Here is a good definition of a Pyramid scheme.

“A Pyramid Scheme is an unsustainable business model that involves promising participant’s payment or service, primarily for enrolling other people into the scheme, rather than supplying real investment or sale of products or services.”

One of this schemes is called Give and Take or Key to a Fortune caused £ 19m loss to a number of people.

Eleven women, aged 34 to 69 became the first in the UK to be prosecuted under new legislation in the Consumer Protection from Unfair Trading Act 2008. Nine of them have been found guilty of stealing money from at least 10.000 victims.

The Scam spread from Bath to Bristol to the West Country and Wales in 2008 and 2009. The victims were encouraged to “beg, borrow or steal” the £ 3.000 needed to invest in the scam. The victims was told they would receive a £ 24.000 pay out when they reached the top of their pyramid chart and promised they would not lose.

The pyramid charts had 15 spaces. Each space was filled with a participant who paid £ 3.000 and introduced two friends, who also paid the amount.

Ones the chart was filled, the eight people at the bottom of the chart paid their £ 3.000 to the person on the top, called the “Bride”

And like any other pyramid scheme the flow of new members dry up and the leaders continue to accept money knowing there is little or no chance of the scheme paying out.

The ones at the top of the Pyramid pocketed up to £ 92.000 each, while 88% of their victims lost between £ 3.000 and £ 15.000

The Give and Take or Key to the Fortune was kept secret as members were forbidden from writing about it to protect the organisers but was uncovered when a person in Bristol complained to UK trading standards that it was promotes in his workplace.

Quick Rich Scheme on the Internet

All about the quick rich scheme cybercrime problem that is widespread all over the internet.

Thursday, 10 September 2015

Type of get rich quick scheme you should avoid

1. Internet business opportunities

Be careful here because if they require down payment to become a “partner” the person paying the fees could be stuck being liable for a business which is later sued on various merits unknown to the new “investor.”

2. High Yield Investment Programs

into with people who are not willing to meet face to face. While these are often risky investments, many of them are Ponzi schemes so be careful when someone suggests you jump on board the next hot thing.

3. Buying real estate and “flipping” a home DIY style

Some people made quite a bit of money flipping houses, others lost everything. Make sure the market in the area being considered for the flip has actually rebounded first before buying a foreclosed home or one on short sale for the best chance of seeing real returns on resale.

4. Stuffing envelopes at home

This includes writing letters, backing envelopes or other envelope jobs from rogue companies which offer pennies (or even a tenth of a penny) on the dollar for each envelope “stuffed.” It will take thousands to make any money and this usually results in the person paying for the privilege of working for a few dollars a day.

5. Books/Seminars/Conferences/Webcasts

Which promise you’ll earn big in real estate/marketing/business/the stock market understand that these people make their money up front by taking payment for the people who attend the conference or meeting. What they say after you have paid for your ticket does not matter and in many cases are complete fabrications on the truth of what happens in that particular industry.

6. Ponzi schemes

The name Bernie Madoff might immediately come to mind, there are other Ponzi schemes to watch out for. Traditional Ponzi schemes take money to one investor to provide returns for another while lining the pockets of the scam artist. Eventually, the money is gone and investors lose out.

7. Selling magnetic “power bracelets” to people in your community who play sports

These have not been uniformly proven to enhance performance so don’t push them on friends, neighbors and family members just yet. You may be stuck with boxes of inventory (bracelets) and no outlet to sell them off to others at the end of the day.

8. Pyramid schemes

These include any scheme where you buy something, are encouraged to get 12 more people “under you” to do the same and you have to encourage them to each bring in 12 more people. Remember, you are never going to really be on the top of this mountain, you are only one of 12 people someone else brought in and will never get much money from this effort

9. Getting paid for Pay Per Click ads online

Understand that these ads are going to make someone rich, but it is not the person who is not owning the website. If you are a writer of a blog and have PPC ads, you will see pennies on the dollar as a result of your creative effort and the webmasters usually put the ads on which they prefer, not which you would rather see adjacent to your content.

10. Getting paid to write reviews online

These include book reviews, reviews of movies or restaurants or the like will never pay out big money in the long or short run. This is because the reviewers are offering their opinion and some never even see the movie, so the reviews are inaccurate and are paid accordingly.

11. Online writing jobs which ask for your personal information in exchange for up front advances for work to be performed in the future

If this sounds too good to be true, it usually is. For this reason and others, no one should ever be given your social security number even if the “employer” claims that he needs it to fill out the appropriate tax forms for your services rendered online. Any online writing job should be verified or it may be a scam where the identity thief is the one who gets the bonus at the end of the assignment, not the writer.

Tips for protecting yourself from getting scammed

- Use your common sense: consider the possibility that the offer may be a scam.

- Remember there are no get-rich-quick schemes, guaranteed or high yielding investments: the only people who make money are the scammers.

- Do not let anyone pressure you into making decisions about money or investments: always get independent financial advice.

- Remember that family members and friends may try to involve you in a scam without realising that it is a scam – you should seek independent advice (from a lawyer or trusted financial adviser)

- Be wary of investments promising a high return with little or no risk.

- If it looks too good to be true, it probably is.

Types of Get-rich-quick Scheme

Quick rich scheme often has not intention in selling real products. It is qualify as pyramid schemes or matrix scheme and is illegal in many jurisdictions. There are many indicators that further confirmed that the scheme is a scam.These are some of the warning signs:

- They will imply that anyone signing up will become rich within months to a year.

- They will tell potential victims that the route to success is by following “secret formulas” that no one else knows about.

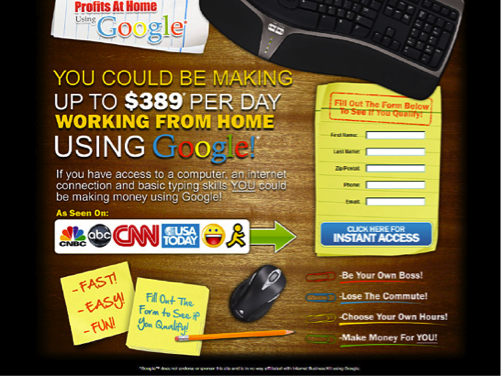

- They will often claim they have been seen on various websites such as Google and YouTube, causing the viewer to assume said websites endorse the product.

- They will use pressuring tactics to get the victim to sign up quickly, such as claiming that there are only a certain amount of copies of a CD left, or using special discount prices that are only available for a short amount of time.

- Schemes such as this will often employ the tactic of displaying testimonials from “previous users.”

- When trying to navigate away from their website, users are often presented with popup windows offering further discounts, in an attempt to make the user feel special.

| Examples of get-rich-quick advertisements |

Also, these scheme's advertisement is highly consisted of 'success stories' to show that they really do give favorable outcome.

Schemes like this will also be advertised through serial promoters. Serial promoters are individuals who are not directly affiliated with a given scheme, but will promote from one to the next almost everyday. In return the owner of the scheme may do the same for them, or if the get-rich-scheme is a Ponzi scheme, the serial promoters will be invited to join early in order for them to make money from new recruits.

Other popular online get-rich-quick schemes can include survey taking, whereby a user would complete surveys of varying subjects and get paid for the time. Get-rich-quick schemes take advantage of this and often promise that users can make a good income from doing this, which is not the case. Individuals who partake in

Thursday, 3 September 2015

What is quick rich scheme?

A quick rich scheme is a plan that promise the participants that they can obtain high rate of return with little risk, and with little skill, effort, or time. This scheme will convince that wealth can be obtained by working at home without exerting any effort. There are legal and quasi-legal get-rich-quick scheme and also illegal schemes(scams). Legal and quasi-legal scheme are frequently advertised on infomercials and in magazines and also in social media such as Facebook. This scheme appears legitimate and highly anticipated because it often show high rates of return to some of the participants but not all. Illegal schemes are often advertised through spam or cold calling over the telephone. These schemes rarely ask participants to invest directly in a concrete scheme. To invest in the scheme is to gamble because it has a very high levels of risk and one has to be prepared to accept it.

Subscribe to:

Comments (Atom)